We collaborate to achieve sustainable success

A leading environmental solution provider

Get in touch with usAFS Energy EU ETS Report Week 45 2025

Do you want to receive to-the-minute up to date info? Please sign up to our client portal and/ or to our EUA Trading Platform.

European climate and energy policy developments took center stage this week as COP30 began, with the EU working to secure approval for its proposed 2040 net-zero target. However, Germany urged a “more realistic” decarbonisation pathway, signaling potential negotiation frictions ahead. Europe’s top human rights court issued a landmark ruling that heightens scrutiny on fossil-fuel projects, reinforcing legal and environmental pressure across the sector. Meanwhile, the EU advanced its long-awaited move to ban Russian gas, though lingering loopholes continue to raise concerns over its practical effectiveness. In the private sector, ExxonMobil cautioned that EU legislation could force a retreat from the region, adding corporate uncertainty to an already complex policy landscape.

Geopolitical tensions around Russian energy remained in focus. Bulgaria sought an exemption from U.S. sanctions tied to Russia’s largest private oil company, while Turkey signaled a gradual shift away from Russian crude in response to Western pressure. Russia’s Lukoil, heavily weakened by sanctions, agreed to sell its international business, a notable concession to global market isolation. Oil prices continued to firm as OPEC approved a small output increase for December, reflecting cautious optimism in demand recovery. Overall, sentiment in European energy and carbon markets remains finely balanced: robust climate ambition and strengthening regulatory pressure are reshaping long-term expectations, even as geopolitical maneuvering and supply-side uncertainty sustain short-term volatility.

Auction volume: 11.5 million EUAs, 2.2 less than last week

Energy Fundamentals

- Gas storage sits at 82.8% full on November 1st

- Berlin calls for “more realistic” EU decarbonisation path to 2040

- Fossil fuel projects face stricter scrutiny after Europe’s top human rights court ruling

- .COP30 kicks-off today, where EU works to approve net zero by 2040 goal

- Bulgaria requests exemption to U.S. sanctions against Russia’s largest private oil company

- Turkey moves towards buying less Russian oil in response to Western sanctions

- Oil prices rise and OPEC agrees upon small output increase for December

- Crashed by punishing US sanctions, Russia’s Lukoil accepts offer to sell its international business

- Europe finally moves to ban Russian gas but potential loopholes remain

- ExxonMobil warns EU law could force exit from Europe

Investment Funds

- Investment funds increased their net long position to +93.89m EUAs on October 29th (vs. +94.72m EUAs on October 17th).

- Gross short positions increased to -27.99m EUAs (vs -28.25m EUAs).

- Gross long positions increased to 121.88m EUAs (vs. 123m EUAs).

Market Prices:

- Indicative Dec25 EUA Price: € 79.78

- Indicative Spot EUA Price: €79.57

- YTD Spot EUA Price: € 72.284

- MTD Spot EUA Price: € 78.227

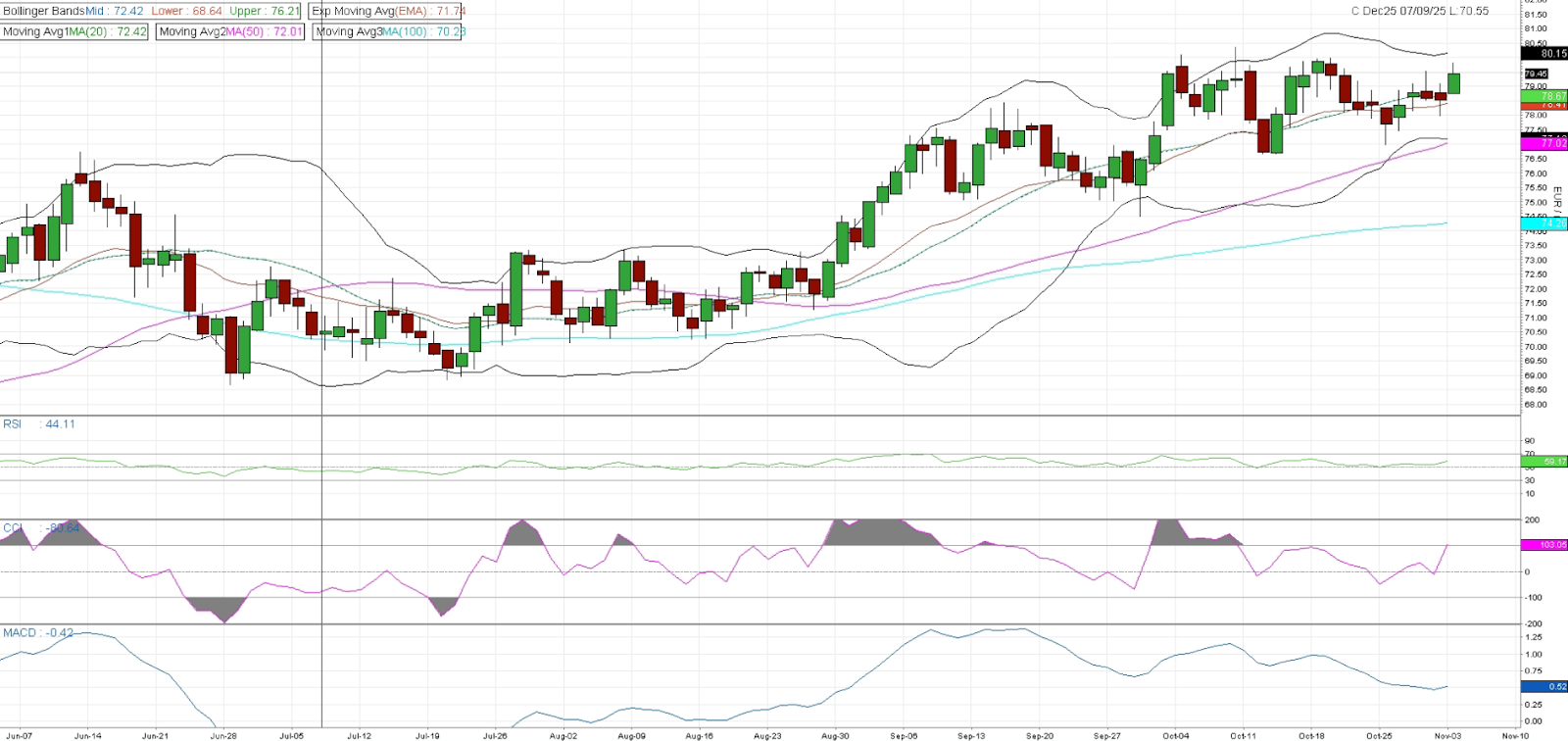

Chart A: December 2025 EUA Price (EUR)

Technical Analysis

EUAs have eased slightly after briefly pushing into the upper Bollinger Band near €79.50–€80.00. Bollinger Bands remain moderately expanded, reflecting the prior up-leg, though the current sideways drift suggests a digestion phase. The recent price action shows a pause in bullish momentum as price consolidates just above the 20-day moving average (€78.10), while the 50-day MA (€77.20) continues to act as immediate dynamic support. The 100-day MA (~€70.20) remains well below current price, confirming the broader bullish structure remains intact. Momentum indicators suggest the market is consolidating rather than reversing, with RSI near 59 showing mild bullishness. MACD is flattening around 0.52, while CCI at +103 points to a tentative short-term recovery. Key Fibonacci levels highlight near-term support zones and deeper corrective areas, while an upside breakout points toward higher resistance levels. On the upside, the market is still struggling with overhead resistance at €80.50, and a confirmed breakout above this level would open the path toward €81.50–€82.00 (upper band expansion targets).

Overall, the trend remains firmly bullish, but momentum has cooled. Holding above €77.00 keeps the upside scenario intact. A close below that area would suggest a broader corrective move before bulls attempt another push through €80+.

Chart B: December 2025 EUA Price (EUR) - Technical

AFS ENERGY B.V.

The information contained in the AFS Energy EU ETS Report, hereinafter Report, has been compiled or arrived from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness, timeliness, correct sequencing or correctness.

AFS Energy B.V. does not accept any liability, contingent otherwise for (i) the accuracy, completeness, timeliness or correctness of any information provided in the Report, (ii) any decision made, or action taken by you in reliance upon any of them and (iii) any direct or consequential loss arising from the use of the Report. AFS Energy B.V. does not make any representation or warranty about the suitability of the information in the Report.

The information contained in the Report is published for the assistance of the recipient but is not to be relied upon as authoritative or taken in substitution for the exercise of judgement by any recipient.